What is Pre-Sales Consulting? Missteps and Savvy Fixes

Introduction

Pre-sales consulting is the bridge most companies spectacularly fail to build. They’re willing to invest millions in sales teams, marketing campaigns, and slick product demos — yet somehow expect customers to leap across the gap between “interested” and “committed” on their own. This isn’t just a process breakdown; it’s a fundamental misdiagnosis of how B2B buying actually works.

Here’s the reality check: In today’s complex B2B landscape, no one signs a significant contract based on a PowerPoint pitch and a handshake. The days of relationship-only selling are dead. Buyers demand proof, validation, and concrete value projections before they’ll open their wallets — especially with procurement teams scrutinizing every rupee.

After 25 years in boardrooms across nine industries, I’ve witnessed the same pattern: Companies with weak pre-sales functions leak revenue like a sieve, while those who master it convert at rates that seem almost unfair. The difference isn’t about having better products — it’s about better positioning, deeper customer understanding, and evidence-based selling before the formal sales process even begins.

- Pre-sales isn’t a support function—it’s the cornerstone of modern B2B revenue operations

- Most organizations fatally underinvest in the capabilities that bridge interest to commitment

- The highest-converting B2B operations run pre-sales as a strategic discipline, not a reactive service

- Your most expensive asset isn’t your sales team—it’s the qualified leads they’re failing to convert

Table of Contents

- What Pre-Sales Consulting Actually Is (And What It Isn’t)

- The Pre-Sales Consulting Revenue Engine

- How Pre-Sales Dramatically Improves Lead Quality

- Case Studies: Transforming Results Through Pre-Sales Excellence

- Critical Pre-Sales Missteps and How to Fix Them

- FAQ

- Conclusion

What Pre-Sales Consulting Actually Is (And What It Isn’t)

Let’s strip away the jargon. Pre-sales consulting isn’t about premature pitching or technical demonstrations. It’s the disciplined process of understanding a prospect’s business reality, diagnosing their specific challenges, and positioning your solution as the logical answer to their problems—all before the formal sales cycle kicks in.

Here’s what separates elite pre-sales functions from the mediocre:

Pre-Sales Is Not:

- A technical demo team that shows up when sales needs backup

- A proposal factory churning out generic RFP responses

- A passive resource waiting for sales to call in reinforcements

Pre-Sales Is:

- A strategic capability that actively shapes customer perceptions

- A disciplined discovery function that uncovers pain points sales teams miss

- A value quantification engine that transforms interest into business cases

- A risk-reduction function that builds confidence in implementation success

When I was CMO at Polycab, we didn’t just sell wires and cables. We sold infrastructure certainty. The difference was our pre-sales process, which featured extensive site assessments, load pattern analysis, and detailed ROI projections before we ever talked pricing. This approach resulted in a 43% higher conversion rate on enterprise deals compared to our competition.

The truth is that modern B2B buying committees have 6-10 stakeholders, each with different priorities, objections, and evaluation criteria. Product specs satisfy technical evaluators, but they don’t address the financial, operational, or strategic concerns that ultimately greenlight or kill deals. That’s where structured pre-sales consulting creates exponential advantage.

The Pre-Sales Consulting Revenue Engine

Most organizations operate pre-sales as a reactive, request-driven support function. This is precisely backwards. Elite pre-sales operations drive the engagement proactively, following a disciplined methodology that systematically moves prospects from interest to commitment.

Here’s the anatomy of a high-performance pre-sales engine:

| Pre-Sales Phase | Key Activities | Common Failures |

|---|---|---|

| 1. Strategic Discovery | Business context mapping, pain point validation, stakeholder identification | Surface-level questioning, failing to identify hidden decision-makers |

| 2. Solution Mapping | Tailored solution design, competitive differentiation, proof point preparation | Generic solutions, feature-dumping instead of problem-solving |

| 3. Value Engineering | ROI modeling, implementation roadmapping, risk mitigation planning | No concrete value metrics, vague implementation promises |

| 4. Proof Validation | Customized demonstrations, proof of concept projects, reference orchestration | Generic demos, unmanaged POCs, poorly matched references |

| 5. Transition Readiness | Implementation planning, success criteria documentation, handoff preparation | Rushed handoffs, no success metrics, organizational unreadiness |

At Somany Ceramics, we transformed a commoditized product category into a premium consultation-led business by investing heavily in a pre-sales function that could speak the language of architects and interior designers. Our pre-sales teams conducted space visualization workshops, material compatibility studies, and lifecycle cost analyses before formal sales engagement. The result? A 30% jump in premium-product revenue.

The data validates this approach across sectors. According to research from The PreSales Collective, organizations with formalized pre-sales functions achieve:

- 41% higher win rates

- Deals that close 2.3x faster

- Average selling prices 15-25% higher

The difference between adequate and exceptional pre-sales consulting often comes down to formalization. Ad-hoc, reactive pre-sales creates inconsistent results. Systematized, process-driven pre-sales creates predictable revenue.

How Pre-Sales Dramatically Improves Lead Quality

The most expensive resource in your business isn’t your senior sales staff—it’s the time they waste on unqualified prospects. Effective pre-sales consulting doesn’t just improve conversion rates; it dramatically enhances lead quality through systematic qualification that saves your most valuable resources for your most valuable opportunities.

The Lead Qualification Framework That Actually Works

Forget simplistic BANT qualification. In complex B2B environments, effective lead qualification requires a multi-dimensional assessment that combines quantitative scoring with qualitative analysis. Here’s the framework we implemented at Crescentia that has transformed lead quality for our clients:

| Qualification Dimension | Key Assessment Questions | Scoring Weight |

|---|---|---|

| Business Driver Clarity | Is there a clear business problem or opportunity driving this initiative? Is it tied to measurable KPIs? | 25% |

| Decision Process Maturity | Is there a defined decision process with clear stages, criteria, and timeline? Are key stakeholders identified? | 20% |

| Solution Fit Assessment | How closely does our solution align with their specific requirements? Are there any critical gaps? | 20% |

| Competitive Positioning | What is our competitive position? Are we well-differentiated on factors that matter to this prospect? | 15% |

| Implementation Readiness | Does the organization have the resources, capabilities, and commitment to successfully implement? | 20% |

This approach moves beyond simplistic qualification to a nuanced understanding of deal quality. When implemented at a chemical manufacturing client, this framework reduced sales cycle time by 37% while increasing average deal size by 22%—simply by ensuring sales teams focused on the right opportunities.

Proof of Concept: The Ultimate Lead Qualifier

For high-value opportunities, nothing separates serious buyers from tire-kickers like a properly structured proof of concept (POC). But most organizations botch this critical pre-sales tool by making it either too superficial or too comprehensive.

At Polycab, we transformed our enterprise sales process by implementing a tiered POC framework:

- Micro-POC: A rapid 1-2 day assessment focused on a single use case, requiring minimal customer commitment

- Standard POC: A 2-3 week targeted implementation addressing 2-3 critical requirements with clear success criteria

- Enterprise POC: A comprehensive 4-8 week paid engagement functioning as a de-facto first phase of implementation

This approach created a natural qualification funnel that separated serious buyers from those just collecting information. The results spoke volumes: 83% of customers who completed our Standard POC converted to full implementation, compared to just 21% of those who bypassed this step.

The key insight? POCs aren’t just about proving technical capability—they’re about validating customer commitment. By requiring progressively greater investment from prospects (time, resources, and eventually money), you naturally qualify opportunities based on demonstrated commitment, not just verbal interest.

Case Studies: Transforming Results Through Pre-Sales Excellence

Theory is worthless without execution. Let me share real-world examples where structured pre-sales consulting transformed business results across diverse sectors. The common thread? A systematic approach to pre-sales as a strategic discipline, not an afterthought.

Emami: Reclaiming Market Leadership Through Deep Pre-Sales Insights

When I joined Emami as Brand Custodian for Fair & Handsome, the brand was facing intense competition and eroding market share. The conventional approach would have been more advertising or product reformulation. Instead, we invested in a pre-sales insights engine that fundamentally changed our go-to-market strategy.

Our pre-sales teams conducted over 300 in-depth interviews with consumers, channel partners, and dermatologists, uncovering critical disconnects between product positioning and actual usage. This led to a comprehensive repositioning of the ₹800 crore men’s grooming portfolio around specific need states rather than generic promises.

The results were transformative: 20% increase in brand recall, 30% growth in online sales, and—most importantly—regained market leadership in key urban markets. The insight wasn’t in better advertising; it was in better understanding of the market dynamics before we crafted our sales approach.

Somany Ceramics: From Product Selling to Solution Consulting

The tiles and ceramics industry historically operated as a commodity business driven by price and availability. At Somany, we recognized an opportunity to create premium value through consultative pre-sales.

We built a specialized pre-sales team of architects and designers who could engage with key influencers (architects, interior designers, contractors) around 150+ new tile designs. Rather than just presenting product catalogs, our teams conducted design workshops, space visualization sessions, and application consulting.

This transformed the sales conversation from “price per square foot” to “design value per project,” driving a 30% increase in premium product revenue and establishing Somany as a design authority, not just a tile manufacturer.

Chemical Manufacturing: Strategic Advisory Driving Exponential Growth

For a mid-sized specialty chemical manufacturer, we implemented a pre-sales consulting function focused on helping customers optimize their formulations and production processes.

Rather than selling chemicals as inputs, the pre-sales team conducted technical assessments of customer manufacturing processes, identified inefficiencies, and recommended optimal chemical usage patterns. This approach positioned the company as a productivity partner rather than a commodity supplier.

The impact? Revenue growth from ₹100 crore to ₹300 crore in just two years, with margins significantly higher than industry averages. The key was shifting from transactional selling to consultative problem-solving well before the formal sales process.

Polycab: Leveraging Technology to Scale Pre-Sales Impact

At Polycab, we faced a classic scaling challenge: how to deliver high-quality pre-sales consulting to thousands of B2B customers without exponentially growing costs.

The solution was a technology-enabled pre-sales function that combined digital tools with human expertise. We implemented sales force automation to cut response times, funnel tracking to reveal behavior patterns, and a digital configurator that allowed customers to model solutions before engaging sales.

This hybrid approach enabled us to scale pre-sales capabilities across India’s largest influencer-loyalty program, supporting our strategic shift from B2B to B2C. The results included significant market share gains and a successful IPO built on demonstrated growth potential.

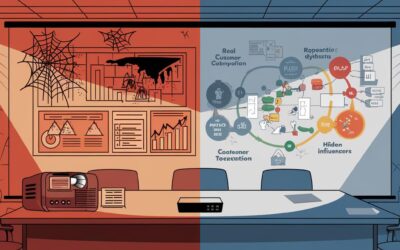

Critical Pre-Sales Missteps and Savvy Fixes

After seeing hundreds of organizations struggle with pre-sales execution, I’ve identified five critical missteps that consistently undermine results—along with practical fixes that don’t require restructuring your entire organization.

Misstep 1: Treating Pre-Sales as Technical Support

The most common mistake is positioning pre-sales as a reactive technical resource that “helps sales when needed.” This subordinate positioning guarantees suboptimal results.

The Fix: Reposition pre-sales as a strategic function with its own metrics, processes, and leadership. At Crescentia, we help clients establish pre-sales as a parallel capability to sales, not a subordinate one. This includes dedicated pre-sales leadership, separate performance metrics, and integration points with both marketing and sales.

A mid-sized manufacturing client implemented this approach and saw a 27% increase in qualification accuracy within three months. The key was shifting from “pre-sales supports sales” to “pre-sales and sales jointly drive revenue through distinct, complementary activities.”

Misstep 2: Generic Discovery and Demonstrations

Most pre-sales engagements fail because they rely on standardized discovery questions and generic demonstrations that don’t address the prospect’s specific business context.

The Fix: Implement a structured discovery methodology that prioritizes business context over technical requirements. This means training pre-sales teams to ask second and third-level questions that uncover the “why” behind the “what.”

For demonstrations, adopt the “Situation-Specific Demo” approach: show only capabilities that directly address specific customer pain points identified during discovery. This requires more preparation but dramatically increases impact. A software client that implemented this approach saw demo-to-proposal conversion rates increase from 31% to 52%.

Misstep 3: Failing to Quantify Value

Too many pre-sales engagements focus exclusively on capabilities without translating them into quantifiable business value. This forces customers to make the value connection themselves—something they rarely do accurately.

The Fix: Develop value quantification tools for every major use case. These don’t need to be complex financial models; even simple calculators that estimate time savings, revenue impact, or cost reduction create a powerful basis for business justification.

At Polycab, we created a “Value Impact Calculator” that pre-sales teams used to estimate energy savings, maintenance reduction, and safety improvements for different wiring solutions. This tool became our most powerful conversion asset, increasing average deal size by 22% by making the ROI tangible.

Misstep 4: Disconnected Handoff Between Pre-Sales and Sales

Even when pre-sales does excellent discovery and solution mapping, value is often lost in a poor handoff to the sales team, creating a disjointed customer experience.

The Fix: Implement a formal handoff protocol that includes joint customer meetings, documented insights, and shared accountability metrics. The most effective model we’ve implemented includes a “Solution Strategy Document” that captures all key discoveries, solution recommendations, and next steps, serving as the handoff artifact between pre-sales and sales.

A chemicals client that implemented this approach reduced their sales cycle by 40% by eliminating redundant discovery and ensuring perfect information transfer between pre-sales and sales teams.

Misstep 5: Measuring the Wrong Metrics

Many organizations evaluate pre-sales on activity metrics (demos delivered, proposals created) rather than outcome metrics that align with business results.

The Fix: Implement a balanced scorecard that includes both activity and outcome metrics. Key pre-sales metrics should include:

- Qualification accuracy (% of qualified leads that convert)

- Discovery-to-demo conversion rate

- Demo-to-proposal conversion rate

- Average deal size influence

- Cycle time reduction

At Emami, we rebuilt our pre-sales measurement system around these outcome metrics and saw a 31% improvement in resource allocation efficiency within six months.

FAQ

How do pre-sales consulting teams differ from sales engineering teams?

Sales engineering typically focuses on technical validation and product demonstrations, while pre-sales consulting encompasses a broader mandate including business discovery, solution design, value engineering, and proof validation. The distinction matters because effective pre-sales teams need business acumen, not just technical expertise. They must speak the language of business outcomes, not just features and functions.

What’s the ideal ratio of pre-sales consultants to sales representatives?

The optimal ratio varies by industry complexity, but our experience shows that high-performance organizations typically maintain a ratio between 1:3 and 1:5 (pre-sales to sales). Less complex products can function at higher ratios (up to 1:7), while highly complex solutions may require ratios approaching 1:2. The key is to measure opportunity coverage and quality, not just headcount ratios.

How should pre-sales consulting be compensated to drive the right behaviors?

The most effective compensation models for pre-sales include three components: a competitive base salary (typically 70-75% of total compensation), a team-based component tied to overall revenue or margin performance (15-20%), and an individual component tied to specific outcome metrics like qualification accuracy or conversion rates (10-15%). This balanced approach aligns pre-sales with revenue outcomes while preserving their objectivity in qualification decisions.

Are we using pre-sales as a crutch for weak sales capabilities?

This is the question smart leaders should ask but rarely do. In many organizations, pre-sales functions expand to compensate for deficiencies in sales capabilities rather than to fulfill their strategic purpose. The test is simple: if your pre-sales teams spend most of their time explaining product features that sales should understand, preparing basic proposals, or handling routine objections, you don’t have a pre-sales function—you have a sales enablement problem masquerading as pre-sales.

Conclusion

Pre-sales consulting isn’t a supplementary function—it’s the fulcrum that leverages your entire go-to-market motion. When executed with discipline, it transforms lead quality, accelerates sales cycles, increases average deal sizes, and improves win rates.

The organizations that consistently outperform in complex B2B environments have recognized that the space between marketing-qualified leads and sales-qualified opportunities isn’t an administrative gap—it’s the strategic terrain where deals are won or lost before formal sales engagement even begins.

The hard truth is that your competitors aren’t winning because they have better products or more talented salespeople. They’re winning because they’ve weaponized pre-sales consulting as a strategic capability that shapes customer perception, builds confidence, and creates compelling business cases while you’re still preparing PowerPoint slides.

Ready to Transform Your Pre-Sales Capability?

Book a confidential pre-sales diagnostic with Crescentia Strategists. In just 90 minutes, we’ll identify your key pre-sales gaps and opportunities, benchmark your current performance, and outline a practical roadmap for improvement.